Say No to Service Cuts in Vancouver’s Budget

A proposal from council could result in a massive reduction of city services in 2026. Use your voice to say that austerity will only worsen the cost-of-living crisis for those struggling the most.

Many people groan at the thought of their property taxes increasing. And it’s understandable why. The cost of living in a city like Vancouver is high.

But property taxes do more than keep the lights on at city hall. They make our city better for everyone by paying for school teachers, firefighters, libraries, community centres, roads, housing support services, sidewalks, bike paths, transit system, street trees, parks, swimming pools, cultural events, and more—all of which are essential to our daily well-being, particularly those of us most impacted by the high cost of living.

Listen to a clip from our CKNW interview on the Vancouver Budget survey and the cost of low property taxes.

Property taxes account for the vast majority of a city's budget. A moderate annual tax increase is fairly standard across cities. That’s because of inflationary pressures, growing demand for services, and the need to catch up on previous governments’ underinvestment in critical infrastructure (think flushing the toilet, clean drinking water, and safe bridges). In fact, city staff informed council that, despite new revenue sources and savings, they’d need to increase the 2026 property tax rates by 5–6% just to maintain existing service levels.

That’s why we were alarmed when Vancouver City Council asked staff to draw up 2026 Budget scenarios with a 0%, 1% or 2.5% tax increase––without indicating where they’d make up the difference.

Cities aren’t allowed to spend more money than they raise. If council follows through on the 0%, 1% or 2.5% increase, they’d have to cut services to balance the budget. The question is: which services would be slashed? When governments limit spending, programs critical to the health and safety of women and marginalized communities are often the first to go. That means housing support services, public washrooms, heat preparedness, road safety, and more are at risk. Staff delivering these services and keeping our city running also deserve to be paid a living wage.

We need to push back against councils’ proposed cuts. Raising property taxes may not be popular, but it is the responsible thing to do when so many people rely on city services to meet their basic needs.

To have your say on what the City should prioritize spending on, we encourage you to fill out the City’s 2026 Budget survey before it closes on September 14th. The city is legally obligated to consult with residents on the budget. Staff will share survey results with council at a public meeting to inform their discussion (see how 2025’s survey results were presented here). While they’re not legally obligated to follow through on what they hear, knowing that there’s support for raising property taxes to avoid cuts to services or wages is an important part of a larger push to ensure programs we rely on aren’t jeopardized.

Learn more about this topic at our Watch Council Drop-in Sessions. The next ones are on Monday, August 25th and Monday, September 8th! At these informal gatherings, we can talk more about how to influence the budget process and even fill out the survey together.

If you’re concerned about the 2026 budget, we’d like to stay in touch about future opportunities to have your say. Sign up for our Watch Council Alerts to hear about opportunities to get involved in key council decisions, including the budget.

To help you fill out the survey, below are some tips on what to include in your responses to key questions.

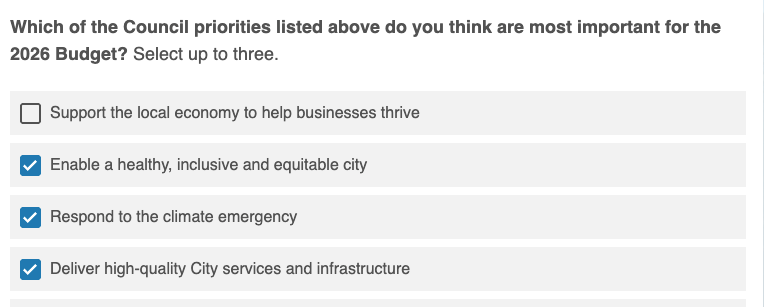

Question: Which of the Council priorities listed above do you think are most important for the 2026 Budget?

Tip: We suggest including any or all of the three areas selected below, as they may be the most vulnerable to funding cuts.

Question: As the City works to manage rising costs while limiting property taxes and maintaining services, we want your input on the best ways to do this. The City has several financial tools available to balance the budget. Tell us how much you support or oppose each of the following options.

Tip: For this question, we suggest supporting

“Increase residential property taxes” because an increase will be necessary to avoid cuts

And opposing

“Continue to offer the same services but not at the same level” because this could result in reduced library hours, fewer grants for front-line organizations, and less staff dedicated to work that supports equity.

“Reduce the number/type of services the City offers” because this could result in planned road safety improvements, recreation programs, or climate action and food security initiatives being cancelled.

“Postpone infrastructure projects” because this could lead to important projects like supportive housing, community centres, and transportation systems being delayed and becoming more expensive.

Note: the order of the options may not look the same for you, as they are randomized.

Question: Given this, which of the following do you prefer for managing property taxes and service levels? Select one.

Tip: We highly recommend selecting 5% for this question, or even suggesting a higher percentage, so that we can demonstrate there is support for continuing to fund services that are underfunded.

Question: Are there any other comments or suggestions you would like to add about the 2026 Budget?

Tip: Here, you can highlight any or all of these points:

Taxes in Vancouver are low compared to similar cities.

With rising cost pressures and a growing city, an increase makes sense.

Cuts will only penalize those struggling most with the cost of living.

A 5% increase over the year will have minimal impact on property owners compared to the impact of reducing services that people rely on to meet basic needs.

More education and transparency on what our taxes fund would be helpful. The city should take a more active role in communicating the risks of not increasing property taxes, as well as what would be supported by an increase in property taxes.

We hope these tips help you speak up. Take the 2026 Budget survey now!

Plus, here are some additional ways to get involved in Vancouver’s 2026 Budget process:

Attend WTC’s upcoming Watch Council Drop-in Sessions.

Sign up for Watch Council Alerts for updates on how to influence the budget this fall, including speaking and/or writing to council about programs you want to ensure aren’t cut.

Want to learn more? Check out our budget-related civic engagement resources:

Understanding the City Budget: Learn more about the budget process that allocates funds for Vancouver’s city services, facilities, and infrastructure, and the differences between the operating and capital budgets.

Influencing the Budget: Whether or not you directly pay property taxes as a homeowner, indirectly as a renter, or work in the city, it’s essential that the budget reflects your priorities too. Learn more about how you can participate in the city’s budgeting process.

Budget Timeline: Get an overview of what the timeline looks like for creating the annual city budget - and what happens if the budget isn’t approved.

How Does the Budget Get Funded?: Learn more about how the City of Vancouver generates revenue to fund the annual budget.